Property investors are always searching for ways to earn more from their rental portfolios and HMO mortgages have become the go-to option for those chasing higher returns. Here is the shocker though. HMO properties can bring in up to 40 percent more annual rental revenue than standard let properties. Many landlords think these mortgages are only for experienced investors but the truth is even newcomers can tap into this lucrative strategy with the right knowledge.

Quick Summary

| Takeaway | Explanation |

|---|---|

| HMO mortgages cater to multi-tenant properties. | These mortgages support property investments with multiple unrelated tenants sharing common spaces, maximising rental income potential. |

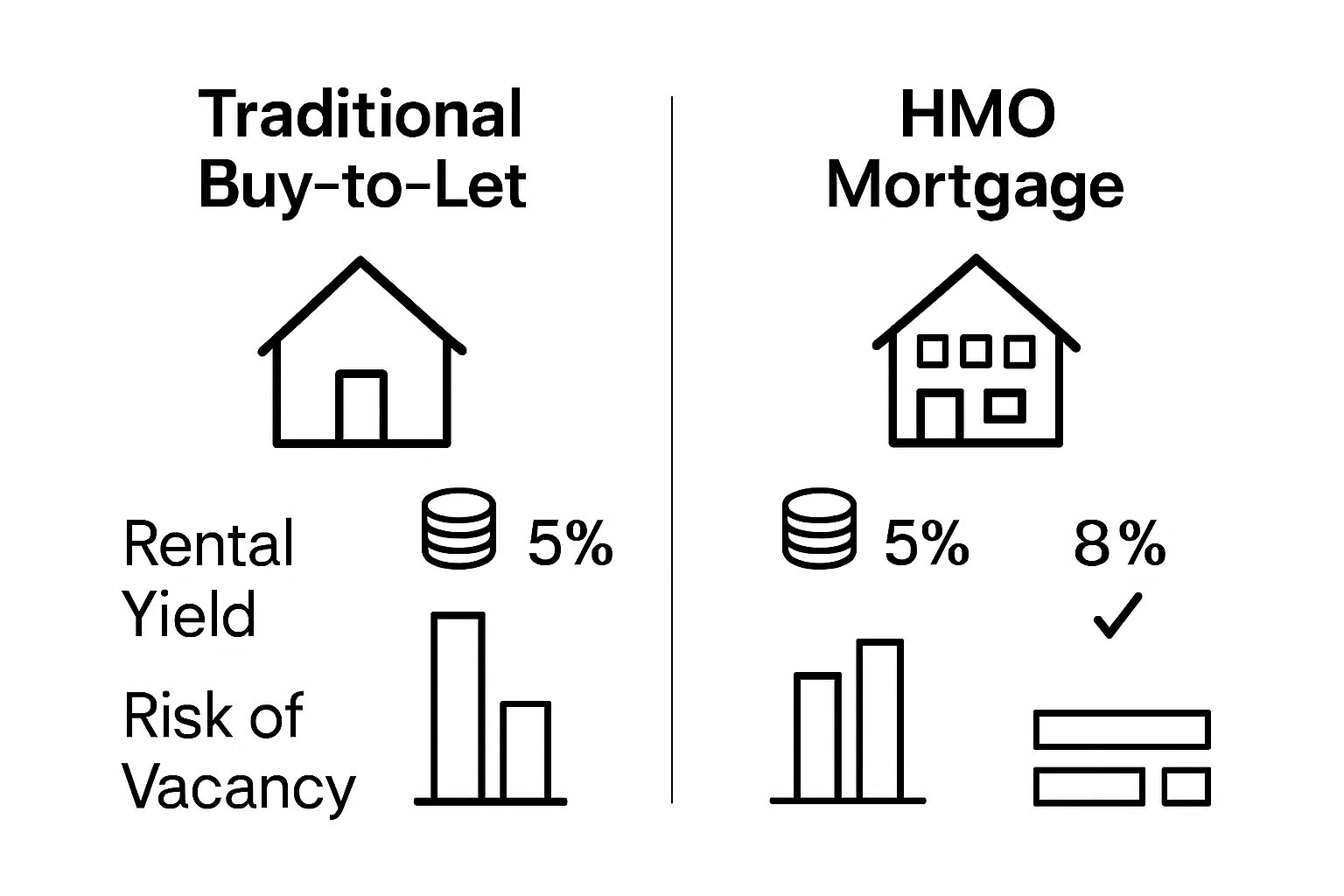

| Higher rental yields compared to traditional options. | HMO properties can generate up to 40% more annual rental income, boosting investors’ returns significantly. |

| Rigorous approval processes for lenders. | Lenders evaluate property and investor qualifications thoroughly, ensuring compliance with HMO regulations before granting mortgages. |

| Enhanced financial and risk management strategies. | HMO mortgages provide diversified income streams, reducing risks associated with tenant vacancies and market fluctuations. |

| HMO investments support urban housing solutions. | These mortgages facilitate the transformation of underutilised properties into viable multi-tenant homes, meeting housing demand in urban areas. |

What is an HMO Mortgage and Who Needs One?

An HMO mortgage represents a specialised financial product designed specifically for property investors targeting Houses in Multiple Occupation (HMO) rental properties. Unlike standard residential mortgages, these financial instruments account for the unique operational dynamics and higher income potential associated with multi-tenant properties.

Understanding HMO Property Investment

HMO mortgages cater to landlords who intend to rent individual rooms to different tenants, typically unrelated individuals sharing common living spaces. These properties generate significantly higher rental yields compared to traditional single-tenant residential properties. Research from the UK Landlord Association indicates that HMO properties can generate up to 30% more rental income than standard buy-to-let investments.

Key characteristics of HMO properties that necessitate specialized mortgages include:

- Multiple unrelated tenants occupying separate bedrooms

- Shared communal areas like kitchens and living rooms

- Typically located in urban areas with high housing demand

- Requiring specific licensing and compliance with local regulations

Who Requires an HMO Mortgage?

Property investors seeking HMO mortgages are typically professionals looking to maximise their rental income potential. These include:

- Experienced property investors targeting higher rental yields

- Landlords managing properties in high-density urban areas

- Individuals with substantial property investment portfolios

- Real estate entrepreneurs exploring alternative investment strategies

Lenders offering HMO mortgages assess applications more rigorously than standard buy-to-let mortgages. They evaluate factors such as the property’s potential rental income, investor experience, and compliance with local HMO licensing requirements. Read more about HMO property investment strategies on our comprehensive marketplace.

Understanding the intricacies of HMO mortgages requires careful consideration of financial implications, regulatory compliance, and potential investment returns.

The Importance of HMO Mortgages in Property Investment

HMO mortgages represent a strategic financial instrument that enables property investors to unlock substantial income potential within the real estate market. These specialised mortgage products are not merely financial tools but critical mechanisms for transforming property investment approaches and generating superior rental returns.

Financial Advantages of HMO Investments

The primary significance of HMO mortgages lies in their ability to generate substantially higher rental incomes compared to traditional single-tenant properties. Research from the UK Property Investment Association demonstrates that HMO properties can generate up to 40% more annual rental revenue than standard residential lettings. This increased income potential stems from the unique structure of renting individual rooms to multiple tenants, allowing investors to maximise property utilisation.

Key financial benefits of HMO mortgages include:

- Enhanced rental yield potential

- Diversified income streams from multiple tenants

- Reduced risk through tenant portfolio diversification

- Faster return on investment compared to traditional buy-to-let models

Risk Mitigation and Investment Strategy

HMO mortgages provide investors with a sophisticated approach to property investment risk management. By enabling multiple tenant occupancy, these financial products create inherent income stability. If one tenant vacates, the property continues generating revenue from remaining occupants. Explore comprehensive HMO investment strategies to understand how these mortgages transform traditional property investment paradigms.

Unique characteristics that make HMO mortgages crucial for modern property investors include:

- More resilient income generation

- Greater flexibility in urban property markets

- Potential for faster capital appreciation

- Advanced financial planning opportunities

Successful property investors recognize HMO mortgages as sophisticated financial instruments that transcend traditional real estate investment models, offering unprecedented opportunities for strategic wealth generation through intelligent property management.

How HMO Mortgages Function: Key Principles Explained

HMO mortgages operate through a complex financial framework that distinguishes them from traditional residential lending products. These specialised mortgage instruments are designed to accommodate the unique operational characteristics of multi-tenant properties, providing financial solutions tailored to the specific risks and opportunities inherent in Houses in Multiple Occupation.

Mortgage Assessment and Underwriting

Research from the Royal Institution of Chartered Surveyors highlights that HMO mortgage assessments involve significantly more rigorous evaluation criteria compared to standard buy-to-let mortgages. Lenders scrutinise multiple factors to determine loan viability and risk profile:

- Property’s potential rental income generation

- Investor’s experience managing multi-tenant properties

- Compliance with local HMO licensing requirements

- Property’s physical condition and conversion potential

- Projected occupancy rates and tenant demographic

Financial Structuring and Risk Management

The financial architecture of HMO mortgages incorporates sophisticated risk mitigation strategies. Lenders typically require higher deposit contributions, often ranging between 25% to 40% of the property’s total value, reflecting the increased complexity of multi-tenant property management. Interest rates are correspondingly adjusted to reflect the elevated risk profile.

Key financial principles governing HMO mortgage structures include:

- Higher lending criteria compared to standard residential mortgages

- More extensive documentation requirements

- Stricter rental income verification processes

- Comprehensive property condition assessments

Learn more about selling HMO property portfolios and understand the nuanced financial mechanisms that drive successful property investments. Successful investors recognise that HMO mortgages represent more than financial products they are strategic tools for navigating the complex landscape of multi-tenant property investment.

Factors Influencing HMO Mortgage Approval and Terms

HMO mortgage approval represents a complex evaluation process where lenders meticulously assess multiple dimensions of risk and potential profitability. The intricate nature of these specialised financial products demands comprehensive scrutiny beyond traditional residential mortgage considerations.

Investor Profile and Experience Assessment

Research from the Royal Institution of Chartered Surveyors emphasises that investor credentials play a pivotal role in HMO mortgage approvals. Lenders conduct thorough background investigations to determine an applicant’s suitability and competence in managing multi-tenant properties.

Key investor profile elements evaluated include:

- Previous property investment track record

- Professional qualifications in property management

- Understanding of HMO legal and regulatory frameworks

- Financial stability and credit history

- Demonstrated ability to manage complex rental environments

Property Characteristics and Risk Evaluation

The physical property itself undergoes rigorous assessment to determine mortgage viability. Lenders examine structural integrity, potential rental income, and compliance with local housing regulations. These evaluations extend far beyond standard property valuations, requiring comprehensive understanding of multi-tenant property dynamics.

Critical property assessment factors comprise:

- Potential gross rental income

- Location and local housing market conditions

- Property conversion potential

- Compliance with HMO licensing requirements

- Maintenance and renovation costs

Explore specialist HMO finance solutions to understand how these intricate assessments translate into mortgage terms. Successful property investors recognise that transparent documentation and strategic property positioning are fundamental to securing favourable HMO mortgage conditions.

The approval of HMO mortgages depends on several specific property and investor characteristics. The following table organises the key assessment criteria lenders use when reviewing HMO mortgage applications.

| Assessment Factor | Relevant Criteria Considered |

|---|---|

| Investor Experience | Track record, property management qualifications |

| Legal Compliance | Adherence to HMO licensing and local authority requirements |

| Property Condition | Structural soundness, conversion suitability, maintenance needs |

| Rental Income Potential | Projected gross rental income, local market demand |

| Location | Urban density, tenant demand, proximity to amenities |

| Financial Stability | Applicant credit history, available capital, risk profile |

| Documentation | Proof of income, licensing, regulatory compliance |

Real-World Applications and Benefits of HMO Mortgages

HMO mortgages transcend traditional property investment strategies, offering sophisticated financial solutions for investors seeking to maximise property portfolio performance. These specialised lending instruments provide unique opportunities to generate substantial rental income through strategic multi-tenant property management.

Strategic Investment Portfolio Development

Research from the UK Property Investment Association reveals that HMO property investments consistently outperform traditional residential rental models. Sophisticated investors leverage these mortgages to create diversified, high-yield property portfolios that generate multiple income streams from a single property asset.

Strategic investment benefits include:

- Enhanced rental yield potential

- Reduced vacancy risk through multiple tenant occupancy

- Greater financial flexibility

- Improved capital appreciation prospects

- More robust income generation mechanisms

Urban Property Market Optimization

HMO mortgages enable investors to capitalise on high-density urban property markets where housing demand consistently exceeds supply. These financial products provide crucial support for transforming underutilised residential properties into efficient multi-tenant accommodation solutions, addressing critical housing needs while generating significant investment returns.

Key urban property market advantages encompass:

- Maximising property utilisation in metropolitan areas

- Supporting affordable housing solutions

- Creating flexible living arrangements for diverse tenant demographics

- Generating superior rental returns compared to traditional models

- Contributing to efficient urban housing infrastructure

Explore comprehensive HMO investment opportunities to understand how these sophisticated mortgage products can transform your property investment strategy. Successful property investors recognize HMO mortgages as powerful financial instruments that deliver sustainable, long-term wealth generation potential through intelligent property management and strategic market positioning.

Ready to Secure the Right HMO Mortgage for Your Investment?

Navigating the world of HMO mortgages can feel overwhelming. The article highlights how challenging it is for property investors to meet strict lender criteria, stay compliant with ever-changing regulations, and maximise returns amid fierce competition. Understanding the complexity of multi-tenant rental income, licensing requirements, and lender scrutiny is crucial for maximising profitability and protecting your investment.

Why wait to make your next move? At agenthmo.co.uk, you gain direct access to trusted estate agents, finance specialists, and up-to-date market insights tailored for HMO property investors. Ready to find the best HMO mortgage or need help selling an existing HMO? Explore our marketplace for HMO property investment opportunities or connect with specialist finance providers who understand your goals. Take the next step today to unlock the full potential of your HMO investment journey.

Frequently Asked Questions

What is an HMO mortgage?

An HMO mortgage is a specialised financial product designed for property investors who wish to rent out Houses in Multiple Occupation (HMO). It differs from standard residential mortgages as it accounts for the unique dynamics and higher income potential associated with multi-tenant properties.

Who would benefit from an HMO mortgage?

HMO mortgages are typically beneficial for experienced property investors, landlords managing properties in urban areas with high demand, or anyone looking to maximise rental yields through multi-tenant arrangements.

How do HMO mortgages differ from buy-to-let mortgages?

HMO mortgages involve more rigorous assessments than standard buy-to-let mortgages. Lenders evaluate potential rental income, investor experience, and compliance with local regulations, making the approval process more complex.

What are the financial benefits of investing in HMO properties?

Investing in HMO properties can lead to higher rental yields, diversified income streams, reduced risks through tenant portfolio diversification, and faster returns on investment compared to traditional buy-to-let models.